Beyond 60/40: Using Options-Based Strategies in Portfolios - Cboe Derivatives Market Intelligence

Mandy Xu

▬

March 14, 2025

Executive Summary:

- Options-based strategies have seen impressive growth in recent years, whether it’s through ETFs, mutual funds, or separately managed accounts (SMAs). Total AUM in “derivative income” funds have jumped 8x since 2019, from $20bn to now over $160bn while total AUM in “defined outcome” funds have grown 20x from $3bn to $60bn.

- What explains the rise in popularity of these strategies? One key driver is changing equity/bond correlation on the back of higher inflation. As the correlation between stocks and bonds shift from negative to positive, the diversification benefit of holding fixed income erodes, as bonds are no longer a risk reducing asset in a typical 60/40 portfolio. In response, investors have turned to alternatives, including options-based strategies to help manage portfolio risk.

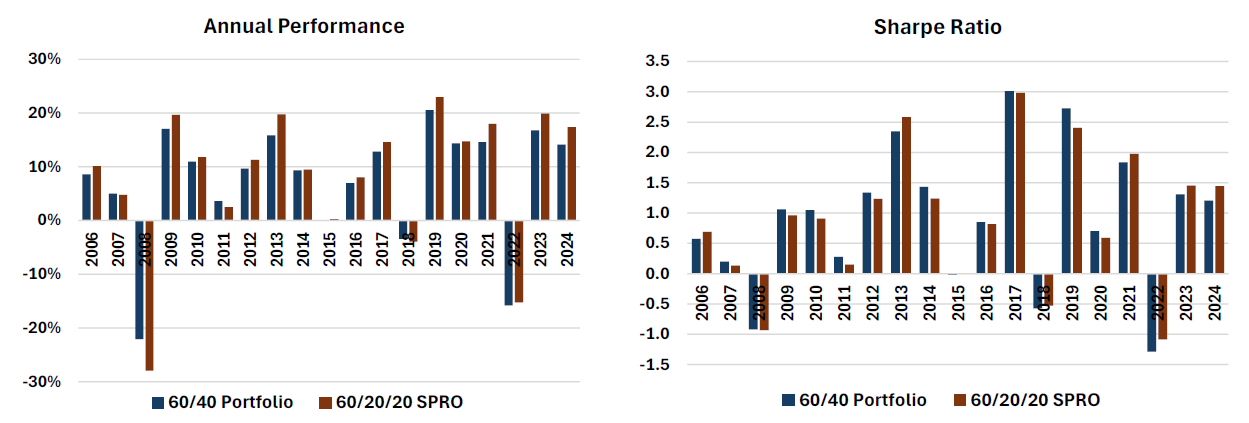

- See full report here as we take an in-depth look at how an allocation to an options-based strategy can help reduce portfolio risk, enhance returns, and diversify income. As an example, a 60/20/20 portfolio of 60% stocks (SPX® Index), 20% bonds (Bloomberg US Agg Index), and 20% in a defined outcome strategy (SPRO Index) has outperformed a 60/40 portfolio (60% stocks, 40% bonds) in 15 of the past 19 years, with a higher Sharpe ratio in each of the last 4 years.

Chart: Risk/Return Comparison of a 60/40 vs. 60/20/20 (20% in a defined outcome strategy) Portfolio

Source: Cboe

[Download Full Report Here]

[Subscribe Here]