Derivatives Market Research

Trending

Introducing “Tales of the Tape” – Episode 1: What to Watch in Options Markets

In the inaugural episode of our podcast, Tales of the Tape, Cboe’s Henry Schwartz, VP, Derivatives Market Intelligence, provides his take on how the doubling of options volume has impacted markets over the past six years.

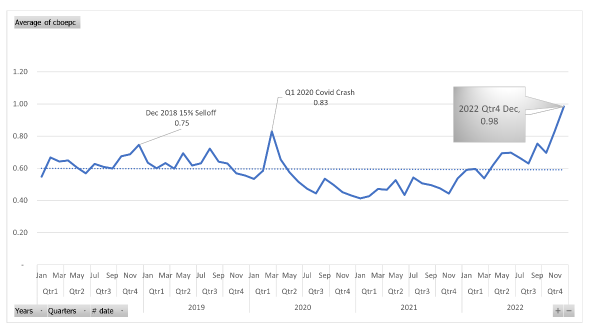

Read MoreThousands of optionable securities, hundreds of thousands of strikes, millions of trades, billions of messages - these stats describe the U.S. equity options trading ecosystem on a daily basis. In the inaugural episode of our podcast, Tales of the Tape, Cboe’s Henry Schwartz, VP, Derivatives Market Intelligence, provides his take on how the doubling of options volume has impacted markets over the past six years. The chart below gives an indication of this high-powered growth. Annual options volume increased from 4.9 billion in 2019 to 12.28 billion in 2024, with growth expected to continue into 2025.

As he walks through the market's evolution, Schwartz comments on market maker adaptation, retail's appetite for options trading tools and short-term trading, as well as the types of trades executed on Cboe’s trading floor, the potential for individually tailored options and leveraged Exchange Traded Products (ETPs). Listen here on Spotify, here on Apple Podcasts, or watch the recording below.

Sections

0:00 – Intro

1:00 - Henry's Background: Options Trading, Entrepreneurship and Market Data

4:40 - Options Proliferation Among Retail Traders

8:40 - Market Participants Handling of Increased Activity

12:00 - Bespoke Options and FLEX Options

17:30 - Trading Floor Utility and Box Spreads

25:30 - Future Innovations

29:00 - Exploring Contra Exercise

37:50 - Leveraged and options-based ETPs

“Tales of the Tape” marks Cboe’s foray into podcasting and will feature monthly discussions with market participants and Cboe experts that dive into financial topics that impact global markets, make careers, and offer timeless takeaways. Subscribe and follow our social channels to catch new episodes and more Cboe updates.

Disclaimer: There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2025 Cboe Exchange, Inc. All Rights Reserved.